The Smoky Mountain short-term rental (STR) market continues to evolve. The October 2025 STR sales tracker gives us a picture of where the market is heading. From shifting price patterns to changes in inventory, this month’s STR sales highlight important trends in buyer behavior, seller expectations, and overall market balance. Join us as we dive into the October 2025 STR sales tracker.

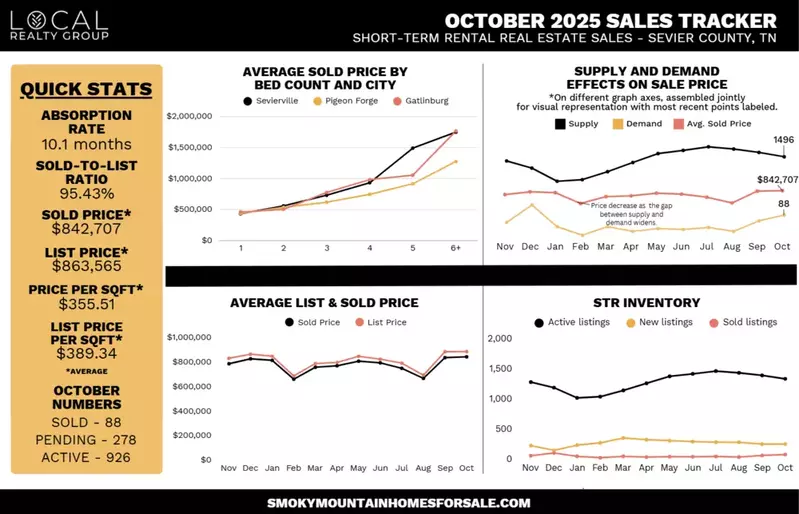

Average Sold Price by Bed Count and City

The data in the October 2025 STR sales tracker shows clear differences in average sold prices by both bedroom count and city in the Smoky Mountain STR market. Larger cabins command significantly higher prices. Properties with six or more bedrooms remain the most expensive, followed by five-bedroom units and so on. The cities of Gatlinburg, Pigeon Forge, and Sevierville continue to play different roles in the market. Sevierville properties tend to have higher average prices for larger bed counts, while Pigeon Forge generally shows more affordable pricing for most bed counts.

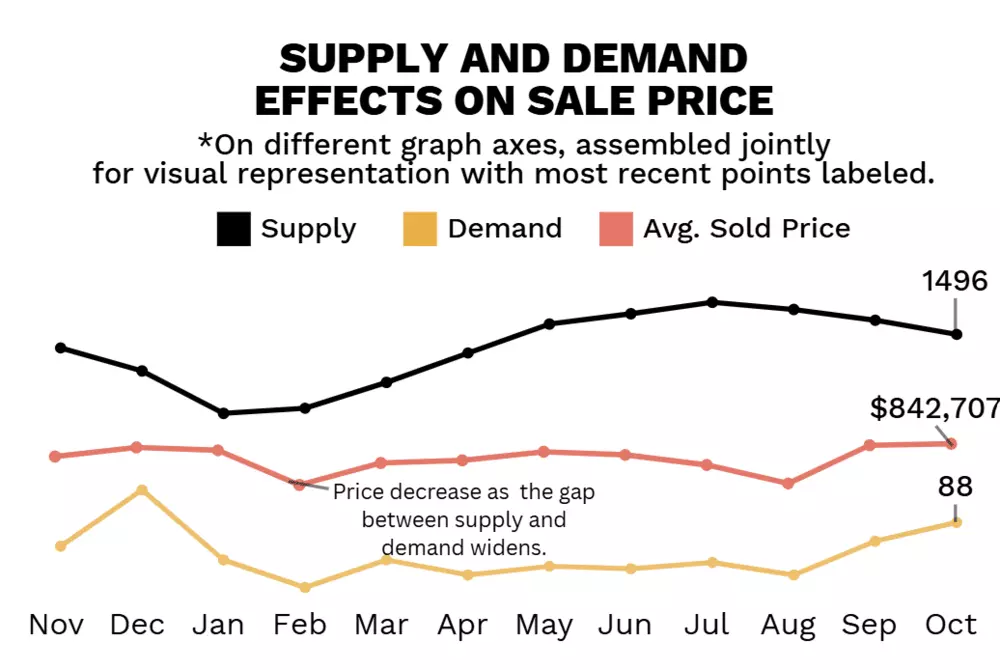

Supply and Demand Effects on Sale Price

The October 2025 STR sales tracker reveals some important supply-and-demand dynamics at work. When comparing list prices to sold prices, there is a narrowing gap, which may indicate the market is adjusting to more realistic valuations. Prices are now converging toward what buyers are willing to pay. On the supply side, inventory appears to remain elevated. The number of STR units available for sale is not shrinking, suggesting that some investors may be exiting or rebalancing their portfolios. This growing inventory, unless matched by rising buyer demand, may put downward pressure on prices, particularly for the larger, more expensive units.

Average List and Sold Price

A significant metric in the October 2025 STR sales tracker is the relationship between average list price and average sold price. While list prices remain high, likely reflecting owners’ ambitions or continued confidence in STR potential, the average sold price is slightly lower. This divergence suggests that buyers are still negotiating, and not all sellers are achieving their list prices. Compared to prior months, the gap is tightening, which means sellers may be adjusting expectations or buyers may be gaining confidence in submitting more competitive offers. We are likely witnessing a period of price correction, a healthy sign for long-term sustainability in the Smoky Mountain STR market.

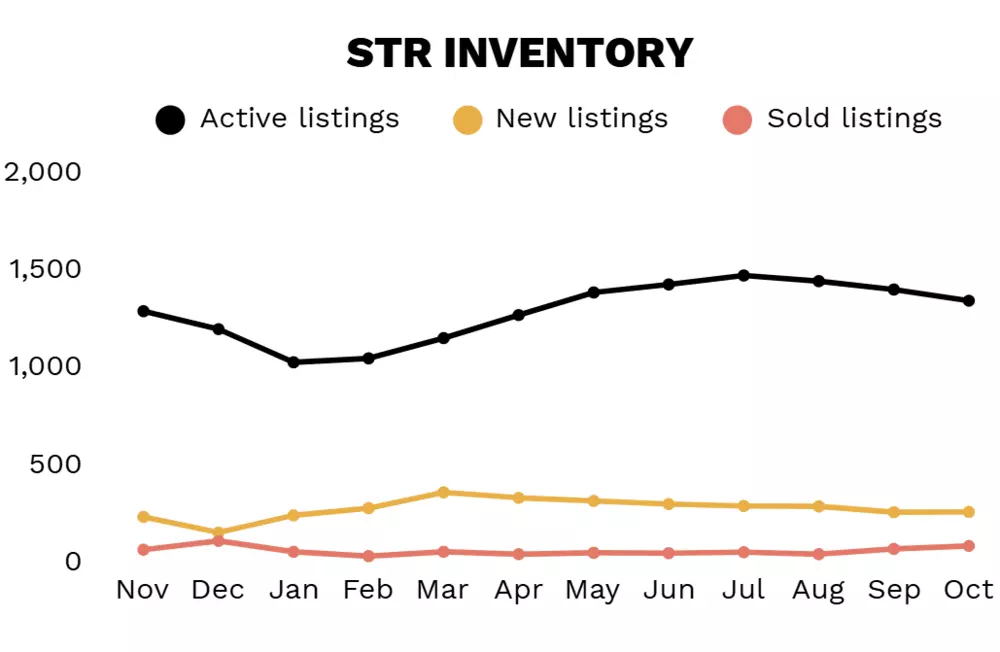

STR Inventory

It’s important to pay attention to inventory in the October 2025 STR sales tracker. Despite steady transactional volume, the number of active STR listings appears to be holding. Active listings have been growing through most of this year while sold listings have remained fairly steady, indicating that supply may be outpacing demand growth. The absorption rate also suggests that the Smoky Mountain STR market is not overheating. Instead, there is a buildup of inventory, especially in higher bedroom counts. This points to increasing competition among sellers, especially those with multi-bedroom units, and it could lead to more realistic pricing and more motivated sellers in the coming months.

Quick Stats

Here are some important statistics to know from the October 2025 STR sales tracker:

- Absorption Rate: 10.1 months

- Sold-to-List Ratio: 95.43%

- Average Sold Price: $842,707

- Average List Price: $863,565

- Average Price Per Square Foot: $355.51

- Average List Price Per Square Foot: $389.34

- Sold Units: 88

- Pending Units : 278

- Active Units: 926

Invest in Smoky Mountain STR Real Estate

So, what does this mean for someone considering investing in Smoky Mountain short-term rentals?

- Opportunity in Larger Units: The premium for 4+ bedroom cabins remains strong, and these are likely to continue to be attractive to investors who can operate them profitably.

- Price Adjustment Window: Because sold prices are trending closer to list prices, there may be fewer bargains, but more realistic valuations are emerging. This could benefit disciplined buyers.

- Inventory Risks: With inventory building, oversupply could become a new concern, especially for larger or high-end cabins.

- Know Your Market: Choose your location and bed count carefully, as the data shows meaningful price differentials.

Are you ready to invest in Smoky Mountain real estate? Check out our current Smoky Mountain properties for sale to find the best opportunities for your next short-term rental investment.