Are you thinking about investing in the Smoky Mountains? The Smoky Mountain short-term rental (STR) market can provide a lucrative investment opportunity for new and seasoned investors. September 2025 reveals a number of interesting trends within the STR market. Keep reading as we dive into some of the key takeaways from the September 2025 STR tracker.

1. Purchase Price

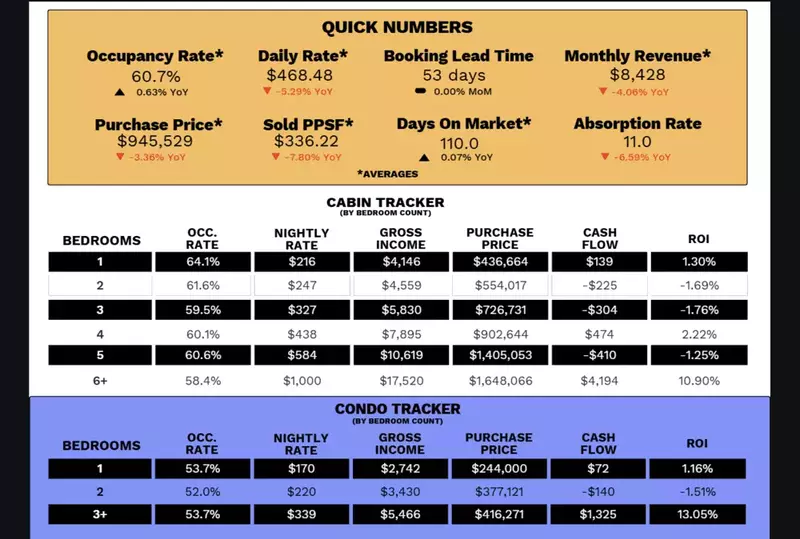

The September 2025 STR tracker for the Smoky Mountain market shows an average purchase price of $945,529. This is down 3.36% compared to the previous year. It is also $6,875 lower than last month, suggesting a continued cooling trend in the region's short-term rental property values. This monthly and annual decline could be attributed to a variety of factors, including increased inventory and changing economic conditions. New investors and potential buyers should closely monitor these trends, as they may signal a more favorable purchasing environment or a need for adjusted investment strategies.

2. Average Daily Rate & Monthly Revenue

For September 2025, the STR tracker for the Smoky Mountain short-term rental market shows an average daily rate (ADR) of $468.48, generating an average monthly revenue of $8,428. This ADR is down 5.29% compared to the previous year, most likely due to increased supply. It dropped $73.02 compared to the August 2025 STR tracker, likely reflecting the seasonal shift to shoulder season in the Smoky Mountain market. Declining ADR could necessitate monitoring occupancy to avoid lower overall revenue.

3. Occupancy Rate

According to the September 2025 STR tracker, average occupancy rate experienced a modest but notable improvement compared to the previous year. At 60.7%, this rate is up 0.63% year-over-year. This incremental rise suggests a positive trend in market strength and demand for short-term rentals within the Smoky Mountain market. However, occupancy rate is lower than last month by 15.6%. Consistent with historical patterns, this decline is most likely attributed to the conclusion of the peak summer travel season and the subsequent return to a more moderate level of tourism in the shoulder season.

September 2025 STR Tracker Quick Numbers

In addition to the key takeaways above, you may also want to consider the following Smoky Mountain STR data from the September 2025 STR tracker:

- Absorption Rate: 11.0 (down 6.59% YoY)

- Booking Lead Time: 53 days (no change MoM)

- Average Days On Market: 110 (up 0.07% YoY)

- Average Sold Price Per Square Foot: $336.22 (down 7.80% YoY)

Invest in the Smoky Mountains

In the Smoky Mountain real estate market, short-term rentals can be a valuable addition to your investment portfolio. Here at Local Realty Group, our goal is to help you understand the local STR market so you can optimize your investment strategy and make informed decisions. Our realty team has deep connections to the area and is dedicated to helping you navigate the Smoky Mountain market. Get in touch with a Smoky Mountain real estate professional today to find out how you can build wealth with Smoky Mountain short-term rental properties!