As of October 2025, the short-term rental (STR) market in the Smoky Mountains continues to shift, reflecting broader economic and travel trends. Our October 2025 STR tracker reveals a mixed picture, with some segments thriving while others face increased pressure on returns. Whether you're a seasoned investor or just exploring the market, these insights will help guide STR investment decisions.

Market Snapshot: Demand Softens as Prices Rise

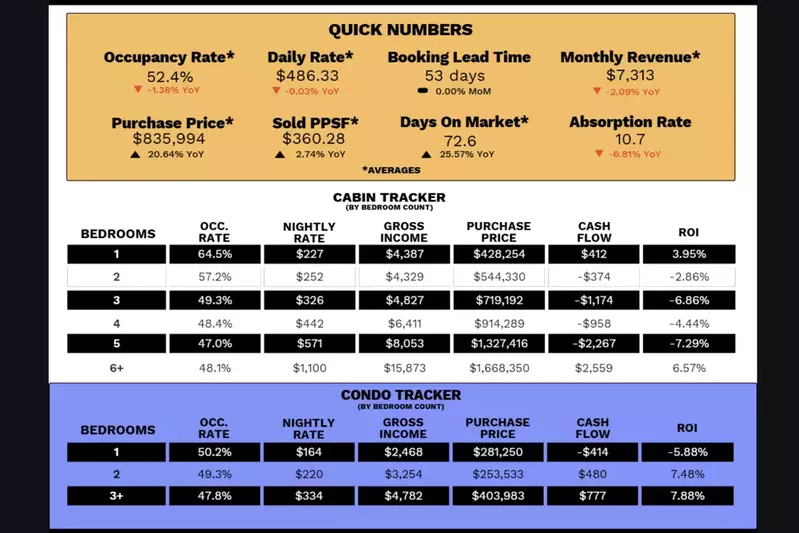

The October 2025 STR tracker shows signs of market cooling. The average occupancy rate dropped to 52.4%, a 1.38% decrease year-over-year. Meanwhile, the average daily rate sits at $486.33, down slightly by 0.03%. Monthly revenue is also down by just over 2% YoY, now averaging $7,313. Booking lead time remains unchanged at 53 days.

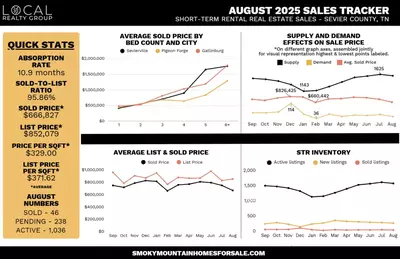

Homes are spending significantly more time on the market compared to last year, now averaging 72.6 days, a 25.57% increase. At the same time, property values have climbed, with the average purchase price rising over 20% YoY to $835,994 and sold price per square foot increasing to $360.28. This environment of rising costs and slightly softening demand is putting more pressure on cash flow and ROI.

Cabin Market Breakdown: Smaller is Smarter

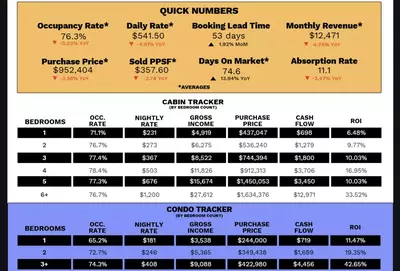

The cabin market tells an interesting story in the October 2025 STR tracker. One-bedroom cabins are currently the most stable and profitable, with an impressive occupancy rate of 64.5% and a nightly rate of $227. These smaller properties generate an average gross income of $4,387 per month, and thanks to a relatively low average purchase price of $428,254, they also offer positive cash flow of $412 and a solid ROI of 3.95%. For entry-level investors or those looking for predictable performance, one-bedroom cabins are an attractive option.

On the other end of the cabin market, two- to five-bedroom properties are facing challenges. Despite decent gross income figures (ranging from $4,329 for two-bedrooms to $8,053 for five-bedrooms) all of these cabin sizes are generating negative cash flow. Five-bedroom cabins are performing the worst with an ROI of -7.29%, despite the highest monthly revenue. Increased purchase prices, operating costs, and tightening margins are making these mid-sized cabins less appealing to investors.

6+ Bedroom Cabins: High Risk, High Reward

Six-bedroom (and larger) cabins stand out as an outlier. With a nightly rate of $1,100 and a gross monthly income of $15,873, these luxury rentals generate strong cash flow of $2,559 per month. Even with an average purchase price of $1.67 million, these properties are yielding an impressive ROI of 6.57%. While the upfront investment is substantial, the potential returns are strong for those willing to manage a larger short-term rental that attracts bigger groups. These types of properties cater well to family reunions, retreats, and group travelers, segments that remain in strong demand year-round in the Smoky Mountain STR market.

Condo Market Update

In contrast to cabins, the condo market appears to be trending more positively according to the October 2025 STR tracker. One-bedroom condos are still underperforming, with an occupancy rate of 50.2%, and a negative ROI and cash flow of -$414 per month. However, two- and three-bedroom condos are showing very strong returns. Two-bedroom condos, priced around $253,533, are bringing in $3,254 per month in gross income and generating $480 in monthly cash flow, resulting in a 7.48% ROI. Three-bedroom (and larger) condos perform even better, offering $777 in cash flow and a 7.88% ROI. For investors seeking lower price points with strong returns, multi-bedroom condos present an excellent opportunity in the Smoky Mountain market.

What This Means for Buyers

The October 2025 STR tracker reveals a few clear trends. Occupancy is declining slightly, suggesting that competition is increasing or traveler demand is softening. Monthly revenue per property is slipping, even as average property prices continue to rise. With days on market increasing, buyers have more negotiating power, but they must be cautious about overpaying, especially in segments showing negative cash flow. ROI, not just gross income, should be the primary decision metric when evaluating investment opportunities. The gap between income and expenses is widening, and only certain property types are holding strong against the pressure.

Key Takeaways

One-bedroom cabins remain a solid option for cash-flow-focused investors, while luxury six-bedroom cabins offer strong upside potential for those with more capital and experience. Two- and three-bedroom condos are currently delivering the best ROI, combining strong performance with lower price points and reduced operating costs. Meanwhile, two- to five-bedroom cabins are struggling to break even and should be approached with caution in the current market.

Invest in the Smoky Mountain Short-Term Rental Market

If you’re considering a short-term rental investment in the Smoky Mountains, our team at Local Realty Group is here to help. We use data-driven insights to guide our clients toward the smartest opportunities in a shifting market. Whether you're buying your first property or optimizing your existing portfolio, let us help you make confident, informed decisions. Reach out to us today to get started.